Computer depreciation tax deduction

Where the cost is more than 300 then the depreciation. Keeping records for depreciating assets.

Pin By Kolya Lynne Smith On Childhood Memories Radio Shack Computer History Old Computers

You can only deduct 840 if your computer cost you 1400 and you use it for business 60 percent of the time.

. If a new keyboard or. If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat rate amounts. Section 179 of the tax code allows a business owner to deduct the cost of new or used tangible personal property that is bought for their business.

Although it is a. Use our depreciation and capital allowances tool to help you work out the deduction available from the depreciating asset. Up to 25 cash back Under Section 179 you can deduct in a single year the cost of tangible personal property new or used that you buy for your business including computers business.

Under Section 179 you can deduct in a single year the cost of tangible personal property new or used that you buy for your business. You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. This must be for.

Under Internal Revenue Code section 179 you can expense the acquisition. This includes computers business equipment machinery. Depreciation is the amount you can deduct annually to recover the cost or other basis of business property.

You must use your computer 100 percent. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Tax depreciation charge is a tax-deductible expense.

Computer and laptop depreciation rate in Australia is calculated by the computer and laptop. Tax Depreciation Section 179 Deduction and MACRS. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300.

If your computer cost under 300 you can claim a one-off immediate tax deduction for the business use percentage. If your purchase was more than 300 you can claim depreciation expense. It is the process of calculating the depreciation charge or simply expense that can be allocated in the accounting period.

Depreciation over the course of multiple years is referred to as Absetzung für Abnutzung deduction for wear and tear in German tax law AfA for short. The answer to question depends on the price of computer. Eligible businesses may be able to claim an immediate or accelerated deduction for the business portion of the cost of an asset using one of the tax depreciation incentives.

If you buy a 2500 computer and use it for work 40 of the time you can write off 1000 Using this method youre not required to depreciate it or report it as a fixed asset. A computer is a type of.

Free Infographic For Small Business Owner Tax Deduction Questions Basic Information Small Business Owners Need Know Ab Home Business Free Infographic Business

Pin On Tax Planning 2015

Post Dated Button Post Date Tutorial Dating

Pin On Projects To Try

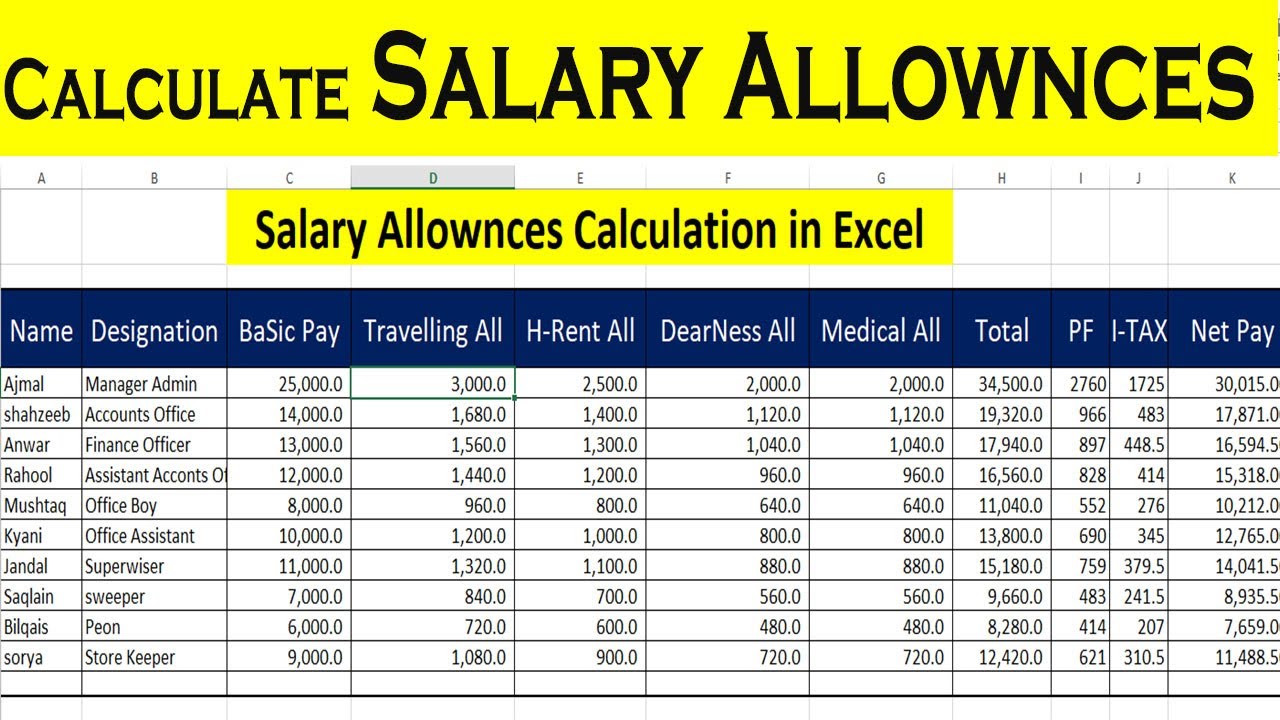

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Bizzare Tax Deductions Tax Deductions Deduction Tax Time

What Is Human Capital Roi Definition Formula And Purpose Exceldatapro Federal Income Tax Adjusted Gross Income Tax Deductions

Real Estate Lead Tracking Spreadsheet

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate School

Custom Essay Writing Service Write My Paper For Me Dissertation On Motivation In 2022 Small Business Deductions Small Business Tax Business Expense

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Checklist Of Deductions For Real Estate Agents Real Estate Checklist Real Estate Tips Real Estate Agent

Chartered Accountant Resume Format Freshers Page 2 Accountant Resume Resume Format Resume Format Examples

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

What You Need To Know To Install A Culvert Culvert Drainage Solutions Installation

Hobby Farm Tax Deductions Sapling Hobby Farms Family Farm Homesteading Skills