38+ how to increase mortgage credit score

Low Credit No Problem. To improve your score keep it under 7.

Buying A Home These Are Ways To Improve Your Credit Score To Make A Mortgage More Affordable The Washington Post

Compare Mortgage Options Get Quotes.

. For the first five years youll usually get a. Web Automate Your Bills. Ad Raise your credit score by removing negative items like inquiries from your credit report.

Pinpoint whats most affecting your scores. Comparisons Trusted by 55000000. Web Try to keep your total credit utilization ratio below 30 to avoid hurting your credit score.

This will improve your income to debt ratio improve your score and make you look better to. Compare Lenders And Find Out Which One Suits You Best. Get Started Now With Quicken Loans.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web Start by paying down balances on credit cards and loans as much as possible. Looking For Conventional Home Loan.

One of the best ways to boost your mortgage credit score is to make sure that you always pay your bills on time. Web The average interest rate on a 30-year fixed-rate home loan was 367 according to April 2015 data from Freddie Mac the most recent available. Ad Take out the guesswork with credit.

You Can Increase your FICO Score for Free. To improve your score keep it under 7. Web Mortgage providers tend to consider a credit score above 700 ideal.

However the type of FICO Scores they request are often older versions due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. And once you have a delinquent. Ad 5 Best Home Loan Lenders Compared Reviewed.

For example if you make 3000 in purchases. One of the biggest factors that will determine the. Web Thats an extra 1568520 over the life of the mortgage just by raising the interest rate by a quarter of a percent.

For instance if you had a 4000 balance on a credit card with a 10000 limit. Ad Compare Mortgage Options Calculate Payments. Ad Learn if You Qualify in 2 Minutes or Less.

Fix Your Credit Score. Pay bills on time. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

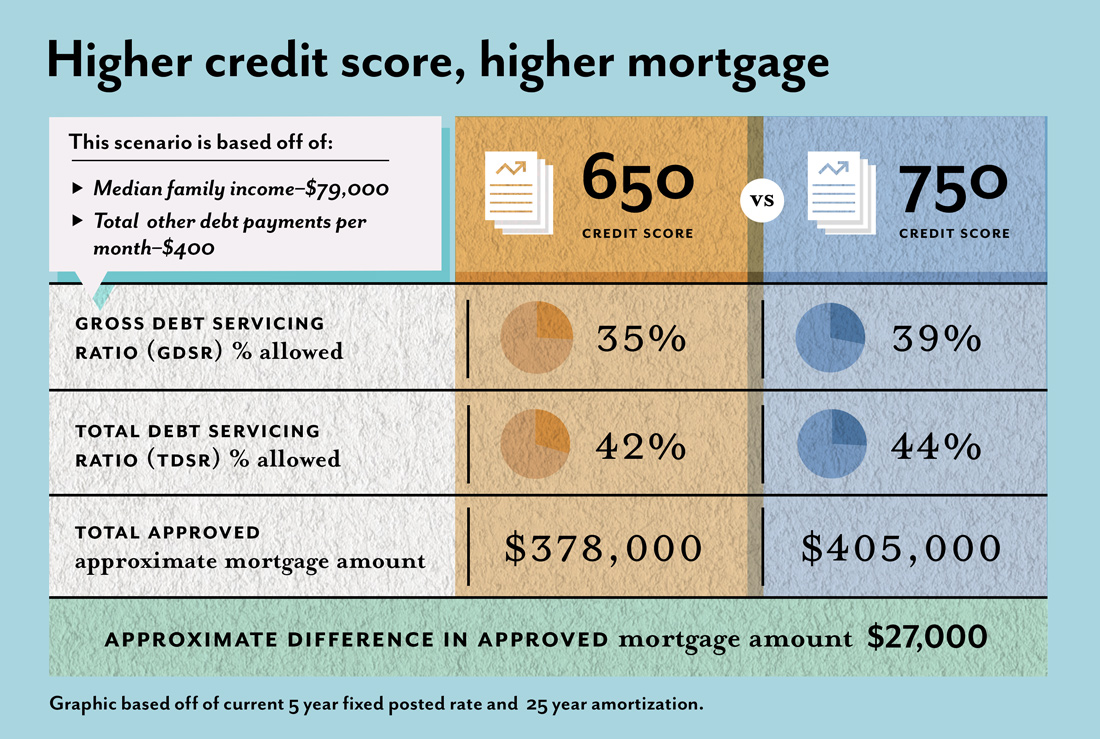

Try to keep it below 30 Rossman said. Web Credit scores play an important role in determining whether you qualify for a mortgagelenders may decline applications from individuals whose credit scores are. Web Looking at this chart you can see your potential savings.

Ad See If Youre Eligible for a 0 Down Payment. Get a Free Quote. Apply Now With Quicken Loans.

Compare Lenders And Find Out Which One Suits You Best. Ad Increase your FICO Score Get Credit for the Bills Youre Already Paying. Looking For Conventional Home Loan.

Pay credit card balances strategically. Web A 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week. 620 Highest mortgage rates.

Add to your credit mix. Get credit for rent and utility payments. Web Try to keep your total credit utilization ratio below 30 to avoid hurting your credit score.

Web According to FICO if your FICO Score is between 760 to 850 you may obtain a 30-year FRM with a 3036 APR. Web When you apply for a mortgage lenders will generally request all three of your credit reports one from each credit bureau and a FICO Score based on each report. Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

If the combined credit. Web One way to keep your balances under 30 is to ask for a credit line increase. It changes to 4625 if you have a FICO.

But getting your score anywhere in the 620-850 range can save you tens of thousands of. Comparisons Trusted by 55000000. Let Us Help You.

Fannie and Freddie Mac generally dont lend to borrowers with scores below 620. Web For example if you make 3000 in purchases and have a 5000 limit you are using 60 of your available credit. No Credit Card Required.

Web Even if you pay your credit card bills in full each month you may still have a high utilization rate Rossman pointed out. The portion of your credit limits youre using at any given time is called your. For instance if your current FICO score is in the 660 - 679 range you could expect a mortgage taken today to cost you 13094 more than.

Web Thanks everyone for the replies. Ad Dispute Your Credit Report Increase Your Score Instantly. Access to all 3 Credit Scores now is more important than ever.

Calculate Your Monthly Loan Payment. Use Funds for Anything. Import your credit report and instantly generate the same dispute letters the pros use.

It sounds like Im being impatient and have to wait for my monthly report to pull to see the updated mortgage scores.

Increase Your Credit Scores Today

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

What Are The Pros And Cons Of A Conventional Loan Quora

What Is A 720 Credit Score Credit Sesame

Keith Leintz Keller Williams Realtor

The Business Credit And Financing Show Podcast Addict

11 Ways To Improve Your Credit Score For A Mortgage Hunker

What Credit Score Is Needed To Buy A House

The Average Credit Score For Approved Mortgages Is Declining

Free 34 Loan Agreement Forms In Pdf Ms Word

8 Ways To Increase Your Credit Score To Get The Lowest Mortgage Rates

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Loan Offer Letter Template 9 Free Word Pdf Format Download

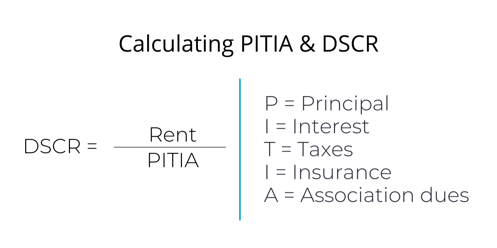

Dscr Loans Visio Lending

Credit Scores Determine Your Mortgage Amount Ratespy Com

Exclusivefocus National Association Of Professional Allstate Agents

How To Raise Your Credit Score 200 Points Credit Strong